State-specific Hemp Farming Regulations

The definition of hemp is a crucial aspect of state-specific hemp farming regulations. Hemp is defined as Cannabis sativa L. and any part of the plant, whether growing or not, with a delta-9 tetrahydrocannabinol (THC) concentration of not more than 0.3 percent on a dry weight basis.

This definition sets the legal threshold for the acceptable hemp THC levels, distinguishing it from marijuana which has higher levels of THC. The distinction is important because hemp is primarily grown for its industrial uses, such as fiber and seed production, while marijuana is cultivated for its psychoactive properties. State regulations often align with the federal definition of hemp to ensure compliance with the Agricultural Act of 2018, also known as the Farm Bill, which legalized hemp production at the federal level.

By clearly defining what constitutes hemp, states can establish rules and regulations that govern the growing, processing, and sale of hemp products within their jurisdiction.

Hemp Varieties

Under the California Food and Agricultural Code (FAC) Section 81002, the cultivation of industrial hemp strains are subject to various regulations. One important aspect is the use of specific hemp varieties that are approved for growth in the state. The California Code of Regulations, Title 3, Section 4920 specifies a list of approved cultivars that growers must adhere to.

These approved hemp varieties are selected based on their characteristics, including their THC levels, growth patterns, and overall suitability for cultivation in California’s climate and conditions. By requiring growers to use only the approved hemp varieties listed in Section 4920, the state aims to maintain the integrity and quality of industrial hemp production.

Adhering to these regulations ensures that hemp crops in California do not exceed the legal THC concentration limit of 0.3%. Additionally, using approved hemp varieties allows the state’s agricultural authorities to monitor and regulate the industry more effectively.

By following the hemp legislation outlined in FAC Section 81002 and using the specified hemp varieties from the California Code of Regulations, growers can navigate the legal and regulatory framework for hemp farming in California and contribute to the sustainable growth of the industrial hemp industry in the state.

State-Specific Regulations

State-specific industrial hemp law for hemp farming vary across the United States. These regulations typically include specific definitions of hemp, guidelines for THC concentrations, and licensing requirements.

For example, in California, hemp is defined as Cannabis sativa L. plants and all nonseed parts and derivatives with a THC concentration of no more than 0.3%. California requires growers to use only approved hemp varieties listed in Section 4920. Adhering to these regulations ensures compliance with the legal THC concentration limit and allows for effective industry regulation.

In Colorado, hemp is also defined as Cannabis sativa L. plants and all parts and derivatives with a THC concentration of no more than 0.3%. Licensing requirements include obtaining a hemp grower license number, providing a legal description of the land where hemp will be cultivated, and submitting a criminal history report.

Other states have similar regulations, with variations in licensing requirements, allowable THC concentrations, and specific guidelines for transportation and access to viable seeds. It is important for hemp growers to familiarize themselves with the specific regulations in their state to ensure compliance and successful cultivation.

Overall, state-specific hemp farming regulations aim to ensure the production of industrial hemp within legal parameters and to facilitate the growth and success of the hemp industry.

Licensing Requirements

Obtaining a license is a crucial step for anyone interested in hemp farming. Each state has its own set of licensing requirements, although there are some common elements across jurisdictions. These requirements typically include submitting an application to the appropriate department of agriculture, providing a legal description in their hemp program of the land where the hemp will be cultivated, and paying a licensing fee.

Additionally, many states require applicants to undergo background checks, which may involve submitting a criminal history report. Some states also have specific requirements for obtaining a hemp grower license number. It is essential for prospective hemp growers to thoroughly research and understand their state’s licensing requirements to ensure compliance and to gain legal permission to participate in the hemp industry.

Licensing Fee

In the state of Ohio, farmers who wish to engage in hemp farming are required to pay a licensing fee. This fee is an essential part of obtaining the necessary permits and authorizations to grow hemp legally within the state.

The licensing fee structure for hemp farming in Ohio consists of several components. First, cultivators must pay an application fee of $100. This fee is required to initiate the hemp farming licensing process. Additionally, there is an annual fee of $500 per growing location. This fee applies to each specific physical field or site where hemp cultivation takes place.

If there are subsequent modifications to the location, such as changing the GPS coordinates, a modification fee of $250 is required for each change. This ensures that accurate records are maintained regarding the precise locations of hemp crops.

It is also important to note that additional fees may be applicable for farmers who cultivate hemp in multiple fields or grow different varieties of the plant. These fees are designed to cover program costs, which may include expenses related to travel, lab analysis, and administrative activities.

The licensing fee for hemp farming in Ohio includes an application fee, an annual fee per growing location, and a modification fee for any changes to GPS coordinates. Additional fees may be required for multiple fields or varieties. These fees are collected to help cover program costs and ensure the effective regulation of hemp farming within the state.

Criminal History Report

In accordance with state hemp farming regulations, a criminal history report is required as part of the licensing process. This report is essential to determine eligibility and ensure compliance with state and federal laws. It serves as a safeguard to protect the integrity of the hemp industry.

The restriction on participation in hemp production based on a criminal conviction for a violation of state or federal controlled substance laws is established by statute and cannot be waived by the USDA. This means that individuals with certain criminal convictions related to controlled substance offenses may be prohibited from participating in the hemp farming program.

Key participants, such as growers, processors, and distributors, are required to undergo a criminal background check. This background check examines an individual’s criminal history to determine if any convictions align with the restricted offenses. By including this requirement, states can maintain the integrity of their hemp programs and ensure that participants are operating within the bounds of the law.

Overall, the criminal history report requirement acts as a vital measure to uphold the standards of the hemp industry and promote compliance with state and federal regulations. It helps to safeguard against potential risks and maintain the reputation of hemp farming as a legal and legitimate agricultural practice.

Key Participants

In adherence to state-specific hemp farming regulations, key participants play a crucial role in the successful implementation of these programs. These key participants typically include growers, processors, and distributors who are directly involved in the production and distribution of hemp-related products.

To ensure the integrity of the program and compliance with the law, each state or Indian Tribe with an approved plan for hemp production is required to define who can participate in their program. Furthermore, they must identify at least one individual from these key participants who will undergo a criminal history check. This step is essential to verify that participants do not have any criminal convictions related to controlled substance offenses.

While the Department of Treasury has provided definitions for “legal entities” and “beneficial owners” that apply to the corporate structure broadly, the definition of “key participant” solely pertains to individuals responsible for complying with the hemp farming regulations.

State departments of agriculture oversee and enforce these regulations, playing a critical role in the licensing and oversight of key participants involved in hemp production. By setting clear guidelines and performing necessary checks, states can ensure that the hemp farming industry operates lawfully and maintains its reputation as a legitimate agricultural commodity.

Production Requirements

In order to ensure the successful and regulated production of hemp, states and Indian Tribes with approved hemp production programs must establish specific production requirements.

These requirements encompass various aspects of hemp farming, including licensing, seed selection, THC levels, disposal methods, and more. Licensing requirements typically involve submitting an application, paying a licensing fee, and providing a legal description and acreage of the hemp crop to be planted. States often require growers to use certified hemp seed or cultivars with THC levels below a certain threshold.

Additionally, states may implement regulations on the testing and remediation of hemp crops that do not meet THC concentration levels. Proper disposal methods for non-compliant cannabis plant material must also be outlined, ensuring that it is effectively disposed of and unable to enter the market.

Overall, these production requirements provide a framework for the cultivation and regulation of hemp crops, maintaining the integrity of the industry while complying with state and federal laws.

Plant Material and Representative Sample

In Arkansas, the state-specific regulations for hemp farming include guidelines for plant material and representative samples. These guidelines are put in place to ensure the accuracy of testing and compliance with THC levels.

According to the regulations, plant material that will be used for sampling should be collected from the flowering tops of the hemp plant. This is where the highest concentration of THC is typically found. The plant material should be representative of the entire plant, meaning it should be a fair and accurate sample that reflects the overall THC content of the crop.

When collecting a representative sample, the regulations specify that a minimum of 30 grams of plant material should be collected. This sample should be taken from a minimum of 20 different plants within a given lot or field. The samples should be labeled and properly stored to ensure their integrity during testing and analysis.

It is important to note that variations or additional requirements may exist depending on the specific regulations of the state. Hemp growers in Arkansas should always consult the official guidelines provided by the relevant authorities to ensure compliance with the regulations.

The guidelines for plant material and representative samples in Arkansas aim to uphold the integrity of hemp farming and ensure accurate testing for THC levels. Following these guidelines is crucial for compliance and marketability of hemp crops in the state.

Reliable Methods for Testing THC Levels

Reliable methods for testing THC levels in hemp crops are crucial to ensure compliance with state-specific regulations. Accurate testing is important because it determines whether the hemp crop meets the acceptable THC concentration level set by the authorities. There are several commonly used testing methodologies that can provide reliable results.

One commonly used method is post-decarboxylation, where the hemp samples are heated to convert THCA (tetrahydrocannabinolic acid) into the active THC. This process allows for the accurate measurement of THC levels in the plant material.

Another important aspect of testing THC levels in hemp crops is the requirement for measuring total THC. Total THC takes into account both delta-9 THC (the psychoactive cannabinoid) and THCA. State-specific regulations often have a specific maximum THC concentration level that must be adhered to.

To ensure reliable testing, hemp growers should rely on certified hemp testing laboratories. These labs have the expertise and equipment necessary to perform accurate and precise THC testing. It is important to select a reputable lab that follows standardized testing procedures and utilizes validated methods.

Reliable testing methods are necessary to accurately determine THC levels in hemp crops and ensure compliance with state-specific regulations. Post-decarboxylation and measuring total THC are commonly used methodologies. Hemp growers should consult certified testing laboratories to obtain reliable results for compliance purposes.

Acceptable THC Level for Hemp Crops

The acceptable THC level for hemp crops is an important aspect of hemp farming regulations. The 2018 Farm Bill, which legalized the production of industrial hemp, sets the standard for THC levels in hemp. According to the Bill, hemp is defined as cannabis plants containing 0.3% or less delta-9 THC on a dry weight basis.

This threshold was established to differentiate hemp from marijuana, which has higher THC levels and is illegal under federal law. The 0.3% limit ensures that hemp crops do not produce the psychoactive effects associated with marijuana.

To determine whether a hemp crop meets the acceptable THC level, testing is conducted on representative samples of the plant material. These representative samples are crucial as they provide an accurate representation of the entire crop. They are usually taken from different areas of the field and from various plants within each area.

Reliable testing methods are essential to ensure accurate THC measurement. Hemp growers should rely on certified hemp testing laboratories that follow standardized procedures and use validated methods. Stakeholder comments and feedback have played a significant role in shaping regulations related to acceptable THC levels, as different perspectives and expertise contribute to a comprehensive and informed approach.

By adhering to the acceptable THC level and conducting reliable testing on representative samples, hemp farmers can ensure compliance with the 2018 Farm Bill and participate in the growing hemp industry with confidence.

Effective Disposal of Non-Compliant Plants or Plant Material

Effective disposal of non-compliant plants or plant material is a critical aspect of state-specific hemp farming regulations. When hemp crops exceed the acceptable THC levels, it is essential to promptly and properly dispose of the non-compliant plants to ensure compliance with the law and prevent the risk of cross-pollination with compliant plants.

State regulations outline several options for the disposal of non-compliant plants. One common method is plowing under the non-compliant plants, where they are tilled into the soil to break down and decompose naturally. This method is often preferred as it allows the plant material to contribute to the soil’s organic matter.

Composting is another disposal method approved by some states. Non-compliant plants can be mixed with other organic materials in a controlled composting process to facilitate decomposition. This method can be beneficial in creating nutrient-rich compost for future use.

Alternatively, burial or burning may be authorized disposal methods depending on state regulations. Burial involves burying the non-compliant plants deep beneath the soil to prevent their reemergence, while burning involves incinerating the plant material completely.

Regardless of the chosen disposal method, it is crucial to document the disposal process and maintain records as proof of compliance. This documentation may include photographs, disposal location details, and a detailed disposal log. It is recommended to consult state-specific regulations to ensure compliance with disposal requirements and to understand any additional documentation needed.

Proper disposal of non-compliant plants or plant material is not only a legal obligation but also an integral part of preserving the integrity and reputation of the hemp industry. By adhering to state guidelines for effective disposal, hemp farmers can demonstrate their commitment to producing high-quality and compliant hemp crops.

Growing Requirements

Before engaging in hemp farming, it is important for farmers to understand and comply with the specific growing requirements set forth by their state regulations. These requirements typically include guidelines for seed selection, plant variety, THC levels, and licensing requirements.

Farmers may be required to obtain a license from the state’s Department of Agriculture and provide detailed information about their hemp crops, such as the number of acres planted, the legal description of the growing area, and the varieties of hemp being cultivated. It is also common for states to establish acceptable THC concentration levels in hemp crops, typically measuring the delta-9 tetrahydrocannabinol (THC) levels.

Additionally, some states may require farmers to submit a criminal history report as part of the licensing process. By adhering to these growing requirements, hemp farmers can ensure their compliance with state regulations and contribute to the successful development of the growing hemp industry.

Square Feet Required for Each Variety of Cannabis/Hemp Grown

When it comes to growing cannabis or hemp, the square footage requirements can vary according to state-specific regulations and licensing requirements. Each variety of cannabis or hemp may have specific requirements in terms of the space it needs to thrive.

One important factor that affects the square footage requirements is the minimum and maximum field sizes for hemp cultivation. Some states have set certain limits on the acreage that can be used for growing hemp. These limits may vary depending on the state’s regulations and the specific licensing requirements.

Apart from the regulations and field sizes, there are also additional factors that may determine the square footage needed for successful cultivation. The type of hemp variety being grown, the desired yield, and the cultivation techniques being used can all impact the square footage requirements. Additionally, factors like climate, soil conditions, and other environmental considerations may also play a role in determining the square footage needed for optimal cultivation.

Overall, it is essential for hemp growers to understand and abide by the square footage requirements set by their respective state regulations and licensing requirements. This ensures compliance with the law and the ability to cultivate hemp successfully. Adhering to these requirements helps support effective hemp production and the growth of the hemp industry.

Legal Description of Land Used for Growing Hemp/Cannabis

In the State of Washington, the legal description of land used for growing hemp is outlined in accordance with state laws. According to RCW 15.140.060, individuals who wish to cultivate hemp must obtain a license from the Washington State Department of Agriculture. This license is required to ensure compliance with regulations and to maintain the integrity of the hemp program.

The legal description of the land used for growing hemp in Washington typically includes specific details such as the address, parcel numbers, and property boundaries. This information is important for accurately identifying and distinguishing the land designated for hemp cultivation.

Similarly, in Michigan, a license is also required to grow hemp, as mandated by the 2018 U.S. Farm Bill. The legal description of the land utilized for hemp production in Michigan includes specific details that enable the identification and differentiation of the designated growing areas.

By including the legal description in the licensing process, both Washington and Michigan aim to ensure that hemp cultivation occurs in authorized locations and according to the regulatory guidelines. This approach establishes a framework for legal hemp production while providing transparency and accountability within the industry.

List of State Hemp Cultivation and Processing Fees (as of publishing)

Alabama

Cultivator Fees

- Initial fee: $200

- License fee per grow site: $1,000 (Includes one sample and analysis of one plot. The fee for sampling and analysis of additional harvests, varieties, and plots will be billed to the licensed grower. The fee for additional analyses is $250 each.)

Processor Fees

- Initial fee: $200

- License fee per processing site: $1,000

Other Info

- $50 discount on applicants applying through Kelly Registration Solutions (the state department of agriculture’s online application processor)

- $1,000 change fee for any changes made after receipt of hemp license

- Annual seed dealer permit fees range from $15 to $700 depending on total gross receipt amount.

Alaska

Cultivator Fees

- Initial fee: $100

- Annual registration cost: $200

- Annual registration renewal: $50 (If an applicant files for renewal, a separate application and all required fees must be submitted for each class of registration, according to the department of agriculture.)

Processor Fees

- Initial fee: $100

- Annual registration for product not intended for human or animal consumption: $250

- Annual processor registration for product intended for human or animal consumption: $750

- Annual registration renewal: $50 (If an applicant files for renewal, a separate application and all required fees must be submitted for each class of registration, according to the department of agriculture.)

Other Info

- Annual retailer registration: $300

- Product endorsement: $100 (Prior to being transported in the state or offered with or without compensation to the consumer, any hemp processed beyond its raw form and intended for human or animal consumption must be endorsed, according to the state department of agriculture.)

- Modification of product endorsement: $100

- Modification of registration: $50

- Pre-harvest collection for sampling: $250

- Transportation permit: $50

- Cost to use a wild, landrace, or seed of unknown origin: $1,200 (The department uses the fee to grow and test these seeds itself.)

Arizona

Cultivator Fees

- Annual grower fee: $1,000

- Annual nursery fee: $650

- Annual harvester fee: $100

Processor Fees

- Annual processing fee: $2,000

Other Info

- Annual transporter fee: $100

- A person, company, college or university conducting not-for-profit research may be exempted from the licensing fee(s).

Arkansas

Cultivator Fees

- Application fee: $50

- License fee: $200

- Site modification fee: $200

- Applied acreage fee: $50-$1,000

- Each applied greenhouse fee: $100

- Each GPS verification fee: $100

- Each harvest/sampling compliance fee: $100

Processor Fees

- Application fee: $50

- License fee: $200

- Site modification fee: $200

- Each GPS verification fee: $100

- Applied processor/handler fee: $500-$1,500

Other Info

- Seed dealer/labeler license: $250* *0.10 per 100 lb if sold under tonnage reporting system on all seed sold non-certified

- More information about seed fees is available here.

California

Cultivator Fees

- Annual registration fee: $900

Processor Fees

- The state does not currently have registration or licensing requirements for processors (or transporters or labs.) Assembly Bill 45 and Senate Bill 235 would establish registration and fees for hemp manufacturers, according to a department of agriculture spokesperson.

Other Info

- Seed seller license: $40 registration fee plus assessment, which is $0.30/$100 sales

Colorado

Cultivator Fees

- Annual grower fees: $500 application fee, plus $5 per acre and/or $0.003 per square foot of indoor square footage

- Registrants selected for inspection and sampling shall pay a fee of $125 per inspection plus all laboratory costs. Registrants selected for inspection and sampling shall reimburse the Department of Agriculture for both fees and costs incurred by the department within 30 days of the date of the invoice.

Processor Fees

- Hempseed processor license: $150 (Those purchasing hempseeds for either resale or processing fall under Commodity Handler Program.)

- Hemp biomass/flower processor license: $275 (Those purchasing biomass and flower fall under Farm Products Program)

- Farm Products Dealers License: $275

- Agent License: $10

- Small Volume Dealers License: $25

- Cash Buyers License: $25

Other Info

- Annual registration fee for hemp production for R&D is the same as for commercial production

Connecticut

Cultivator Fees

- License application fee: $50

- Licensing fee: $450 for first acre of land or greenhouse, $30 for each additional acre; max license fee is $3,000 (license expires after three years)

- Post-harvest inspection per sample: $50

- Per acre site modification fee: $30 per added acre (above the first acre)

Processor Fees

- License application fee for processor of hemp consumables: $50

- License renewal for processor of hemp consumables: $250 (License expires biennially on June 30th)

Other Info

- Academia, state agencies and department research projects are exempt from license application fees and licensing fees

- Seed labeler registration: $100

Delaware

Cultivator Fees

- License fees: $300 (due at initial application and every three years)

- Growing site registration fee for each growing site: $500 (due annually)

- Growing site modification fee per site: $100

Processor Fees

- License fees: $300 (due at initial application and every three years)

- Facility registration fee: $1,000 (due annually)

Other Info

- Handler fee: $100 (due at time of application)

Florida

Cultivator Fees

- No fees (beyond required fingerprint and background check costs)

Processor Fees

- Permit to retail, wholesale, distribute, manufacture, store or process hemp extract for human ingestion: $650 (annual fee)

- Permit to wholesale, distribute, manufacture, store or process dairy products with hemp: $200 for initial cost, $100 for annual renewal

Other Info

- Retail permit: $650 (annual fee)

- Permit to distribute pet food in Florida: $40 to $3,500 (annual fee)

- Seed dealer permit: $10 to $4,600 (annual fee)

- No labs required for transportation or labs. Labs must have an ISO certification, DEA permit and sign the Florida Department of Agriculture and Consumer Services Division of Plant Industry Hemp Lab agreements.

Georgia

Cultivator Fees

- Annual license fees: $50 per acre intended to be cultivated, up to a max fee of $5,000

Processor Fees

- Annual license fee: $25,000 (Processors must also have a copy of a surety bond in an amount between $300,000 and $1 million.)

Hawaii

Cultivator Fees

- No application or license fees—state operates under a USDA license

Processor Fees

- Annual $500 fee for certificate of registration

Idaho

Cultivator Fees

- Temporary, proposed rules:

- $100 annual application fee

- $500 annual registration fee

- Pre-harvest inspection fee: $200 per lot, plus $35 per hour of travel to the site

Processor Fees

- Temporary, proposed rules:

- $100 annual application fee

- $1,000 annual inspection per site, plus $35 per hour of travel to the site

Illinois

Cultivator Fees

- Application fee: $100 (nonrefundable)

- License fees: $375 for 1 year, $700 for 2 years, $1,000 for 3 years

Processor Fees

- Application fee: $100 (nonrefundable)

- License fees: $375 for 1 year, $700 for 2 years, $1,000 for 3 years

Indiana

Cultivator Fees

- Growing license: $750

Processor Fees

- Handler license: $750

Other Info

- Combination grower/handler license: $1,500

Iowa

Cultivator Fees

- License fee for 0-5 acres: $500 plus $5 per acre and a base inspection fee of $1,000

- License fee for 5.1-10 acres: $750 plus $5 per acre and a base inspection fee of $1,000

- License fee for 10.1-40 acres: $1,000 plus $5 per acre and a base inspection fee of $1,000

Processor Fees

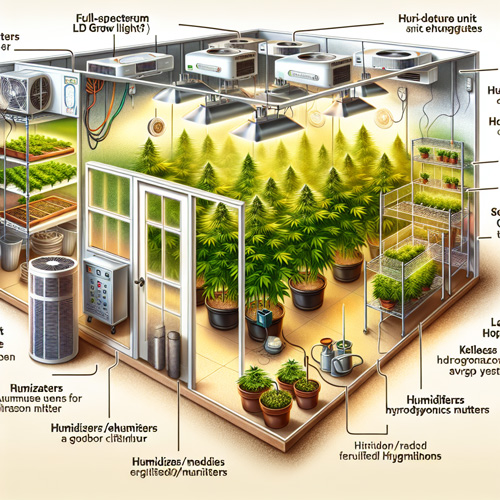

SPONSORED CONTENT

Grow Top-Shelf Cannabis with the Right Light

Deliver optimized light levels in the right spectrum to your light-loving cannabis plants with Philips LED toplighting compact. Multiple spectral options including our new Efficient Broad White, to optimize growth for every stage: veg to flower to mother. Covered, protected diodes are easy to clean, ensuring consistent light output. Catch up with the Philips LED Lighting team at the Cannabis Conference, August 15-17, in Las Vegas. You’ll find us in booth #413

- Annual registration fee: $475

Other Info

- Deadline for 2021 outdoor planting was May 1

- Processing annual registrations due at least 30 days prior to expiration

Kansas

Cultivator Fees

- Application fee: $100

- License fee: $1,200

- Modification fee: $50

Processor Fees

- Proposed fee for chemical extraction processors: $1,000

- Proposed fee for agricultural drying/plant separation processors: $500

- NOTE: All processor fees are proposed and not yet finalized.

Kentucky

Cultivator Fees

- Licensing fee per growing address: $400 (due before license is awarded)

- Cost for each new growing site: $750 (due with submission of any site modification request)

- Cost to process paper applications: $200 (no service charge for online applications)

Processor Fees

- Annual license for handlers (such as private labs, brokers or seed cleaners): $500

- Annual license for grain/fiber processor: $500

- Annual license for flower material processor: $3,000

- Site modification charge: $750

- Cost to process paper applications: $200 (no service charge for online applications)

Other Info

- Grower application and license renewal deadline was March 15.

- Processor applications accepted year-round but renewals are due Dec. 31 of previous year

Louisiana

Cultivator Fees

- Grower license fee: $500 (due upon notification of application approval)

Processor Fees

- Processor license fee: $500 (due upon notification of application approval)

Other Info

- Contract carriers and seed producers also cost $500 each.

- Licenses are valid through end of each calendar year

Maine

Cultivator Fees

- Application fee: $100

- License fee: $500

- Outdoor growing fee: $50 per acre

- Indoor growing fee: $0.25 per square foot

Processor Fees

- No processor licensing program or processor fees

Maryland

Cultivator Fees

- Growing fee: $550 per site

- Research growing fee: $250 per site

Processor Fees

- N/A

Massachusetts

Cultivator Fees

- Application fee: $100 (non-refundable)

- License fee: $300 (annual)

Processor Fees

- Application fee: $100 (non-refundable)

- License fee: $300 (annual)

Other Info

- A dual grower/processor license application costs $100 (non-refundable); licenses cost $500 (annual)

- The deadline to apply for a hemp license was April 30, 2021. To be notified when the 2022 hemp license applications are available, email mahemp@mass.gov to be added to a mailing list.

- To maintain your license, you must apply for renewal between October 1 and December 1.

Michigan

Cultivator Fees

- Application fee: $1,350

- Renewal fee: $1,250

- Site modification fee: $50

Processor Fees

- Application fee: $1,350

Other Info

- License year for processors/handlers runs from Dec. 1 to Nov. 30

Minnesota

Cultivator Fees

- Annual grower license fee: $150

- Annual cost for each grow location: $250

- License change fee: $50 Annual fee

Processor Fees

- Annual processor license fee: $250

Other Info

- The application period for 2022 will open on Nov. 1

Mississippi

Cultivator Fees

- No application or license fees—state operates under a USDA license

Processor Fees

- N/A

Missouri

Cultivator Fees

- Annual registration costs: $750

Processor Fees

- No fee specific for hemp processing

Other Info

- Annual cost for hemp propagule and seed permit: $750

- Annual cost for certified industrial hemp sampler: $50

Montana

Cultivator Fees

- NOTE: Costs are broken down by the type of hemp cultivar being grown

- Licensees who plant a Category C cultivar (a variety/seed not approved by the state department of agriculture): $1,100

- This fee includes the initial inspection and testing of the first Category C sample. An additional $250 testing fee will be required for each additional sample and an additional $250 inspection/sampling fee will be required for each additional inspection.

- Licensees who plant a Category B cultivar (a variety/seed certified to AOSCA/OECD standards): $850

- Licensees who plant a Category B cultivar (a variety/seed previously grown in Montana): $850

- Regardless of category planted, cost of sampling request (e.g., for an insurance claim): $250 inspection fee plus the standard $250 testing fee. (The initial inspection fee and first sample testing fee is waived under Montana’s Pilot Program.)

- Fee for license modification after application is processed: $50 per charge

Processor Fees

- Annual fee for grain/seed/seed oil/fiber processors: $1,000

- Annual fee for floral/root extract processors: $2,500 (this fee also covers the fee for grain/seed/seed oil/fiber processing if a processor is working under both categories.)

Other Info

- Montana seed dealer fee: $75

- Non-resident seed dealer fee: $130

- Fee for Montana or non-resident labeler whose company name and address appears on the seed label: $75

- Fee for a facility (permanent or portable) that conditions seed for sale: $75

- Fee for a Montana producer selling more than $5,000 worth of seed he/she produced on his/her farm: $75

- Per the state department of agriculture website: “The department issues hemp licenses in (2) two progressive stages. Upon approval of the initial application, eligible applicants will be issued a Planting Permit so they may purchase seed or live plants, and seed or transplant hemp. To receive full licensure, the applicant must submit a Planting Report confirming information about the crop(s) that was planted. Successful candidates will be issued the second stage Production license. The Production license allows for the production and harvest of compliant hemp. Any applicant that does not meet the conditions of the Production License will forfeit their Planting Permit and the crop(s) will require destruction.”

Nebraska

Cultivator Fees

- Application fee: $150 (nonrefundable, due at time of application)

- Cultivator site registration fee: $600 per site (due at time of application)

- Site modification fee: $75 (due upon approval of site modification)

- Delinquent fees for renewals: Assessed at 25% of the base fee rate per month on or after:

- February 1, delinquent fee is $187.50

- March 1, delinquent fee is $375

- April 1, delinquent fee is $562.50

- May 1, delinquent fee is $750

Processor Fees

- Application fee: $150 (nonrefundable, due at time of application)

- Processor-handler site registration fee: $1,200 per site (due at time of application)

- Site modification fee: $75 (due upon approval of site modification)

- Delinquent fees for renewals: Assessed at 25% of the base fee rate per month on or after:

- February 1, delinquent fee is $337.50

- March 1, delinquent fee is $675

- April 1; delinquent fee is $1,012.50

- May 1; delinquent fee is $1,350.00

Broker Fees

- Application fee: $150 (nonrefundable, due at time of application)

- Delinquent fees for renewals: Assessed at 25% of the base fee rate per month on or after:

- February 1, delinquent fee is $37.50

- March 1, delinquent fee is $75

- April 1, delinquent fee is $112.50

- May 1, delinquent fee is $150

Nevada

Cultivation Fees

- Application fee: $900 application fee plus $5 per acre or $0.33 per 1,000 square feet

Processor Fees

- Application fee: $1,000

Other Info

- Seed producer certificate costs: $100 application fee plus $5 per acre or $0.33 per 1,000 square feet. The applicant is also responsible for inspection costs at $60/hour/inspector for drive time, inspections, and sampling.

- Laboratory Processing Fee: $40. These fees are expected to increase to better reflect laboratory analysis cost.

New Hampshire

Cultivator Fees

- No application or license fees—state operates under a USDA license

Processor Fees

- N/A

New Jersey

Cultivator Fees

- Application fee: $50 (nonrefundable)

- $300 license fee plus $15 per acre

- Secondary Pre-Harvest Sample Fee for additional site visits mandated by premature Harvest Reports, or Post-Harvest Retest Fee for THC compliance testing conducted by NJDA: $150 per variety, location, instance.

- Site Modification Surcharge: $300 plus $15 per acre for each new growing site, due with submission of any Site Modification Request.

Processor Fees

- Application fee: $50 (nonrefundable)

- Participation fees for each component being processed:

- Handlers: $450 annual fee

- Fiber Processor: $450 annual fee

- Grain Processor: $450 annual fee

- Floral, Oil or CBD Processor Extraction: $1,000 annual fee

- Floral Processor: $1,000 annual fee

- Hemp Seed Oil Processor: $1,000 annual fee

- Site Modification Fee: $300 for each new processing site, due with submission of any site

- Product THC Test Fee: $150 per instance, due within 30 days of invoice by NJDA if a product is selected for THC testing.

Cultivator Fees

- Annual outdoor fees: $650 base registration fee, plus $10 per variety grown, plus $6 per acre of production.

- Annual indoor fees: $750 base registration/inspection fee, plus $10 per variety grown, plus $0.75 per 1,000 square feet of production.

Processor Fees

- Application fee: $1,000 (nonrefundable)

New York

Cultivator Fees

- Application fee: $500 (nonrefundable)

Processor Fees

- Cannabinoid Hemp Processors Extracting and Manufacturing

- $1,000 application fee

- $3,500 license fee

- Cannabinoid Hemp Processors Manufacturing Only

- $500 application fee

- $1,000 license fee

Other Info

- $300 Cannabinoid Hemp Retail License fee

- $300 Distributor Permit fee

North Carolina

Cultivator Fees

- No application fee

- $250 initial license fee (Licenses need renewed every three years.)

- Annual fees:

- $250 for operations with 49 acres or fewer

- $500 for operations with 50 acres or more

- Additional $2 per acre or $2 per 1,000 square feet of greenhouse

Processor Fees

- No processor fees

Other Info

- Annual seed dealer fees

- Wholesale or combined wholesale and retail seed dealer: $125

- Retail seed dealer: $30

North Dakota

Cultivator Fees

- Application fee: $41.25 (nonrefundable)

- Annual fees charged by number of lots

- $100 for one lot

- $200 for two lots

- $300 for three lots

- $350 for four or more lots

Processor Fees

- $200 annual license fee

Other Info

- Businesses can be charged up to $125 for hemp inspection, sampling and testing.

Ohio

Cultivator Fees

- Application fee: $100

- Growing Location: $500 (annual fee per location)

- Site Modification Fee: $250 for each GPS coordinate location change for each growing location.

- All additional samples taken due to the licensed cultivator having multiple fields, greenhouses, buildings, sites, or additional varieties grown on the growing location shall be subject to an additional $150 pre-harvest sample fee per sample taken.

Processor Fees

- Application fee: $100

- Annual license fees for each processing site:

- $500 for processing raw grain

- $500 for processing raw fiber

- $3,000 for processing the raw floral component. This includes extraction facilities and the processing and packaging of smokable hemp.

- Annual license fees for processing cannabinoids in human and animal food, dietary supplements, cosmetics and personal care products for each processing site:

- $500 for wholesale production

- $250 for retail production.

Oklahoma

Cultivator Fees

- Application fee: $500 plus additional $5 per acre and/or $0.33 per square foot of greenhouse (annual costs)

Processor Fees

- Annual fees:

- $1,000 for processors with annual sales less than $50,000

- $2,500 for processors with annual sales between $50,001-$250,000

- $5,000 for sales more than $250,000 annually (annual license)

Oregon

Cultivator Fees

- $250 nonrefundable application fee

- $1,000 certificate fee

Processor Fees

- $250 nonrefundable application fee

- $1,000 certificate fee

Pennsylvania

Cultivator Fees

- $150 for new permits

- $50 for annual renewals

Processor Fees

- $150 for new permits

- $50 for annual renewals

- No separate processing permit is required if hemp grown on the property is also processed on the property, and no other hemp is moved onto the property.

Rhode Island

Cultivator Fees

- Nonrefundable application fee of $250

- $2,500 due upon approval (annual)

Processor Fees

- Nonrefundable application fee of $250

- $2,500 due upon approval (annual)

South Carolina

Cultivator Fees

- $100 nonrefundable application fee

- $1,000

Processor Fees

- $100 nonrefundable application fee

- $3,000 per location

South Dakota

Cultivator Fees

- Nonrefundable $50 application fee

- $500 license fee (annual)

Processor Fees

- Nonrefundable $50 application fee

- $2,000 license fee

- $500 for inspection and records review (annual)

Tennessee

Cultivator Fees

- Less than 5 Acres: $250

- 5-20 Acres: $300

- Greater than 20 Acres: $350

- University: Cost waived

Processor Fees

- Processors are not required to be licensed or registered with TDA for processing hemp; only those processing consumable goods must register as a food manufacturing business. These licenses range from $50 to $750 depending on size and “risk level.”

Other Info

- If your name is on the seed label, you are required to obtain a TN Seed Sellers License.

- Samples cost $150 each.

Texas

Cultivator Fees

- $100 application fee

- $100 registration fee per facility

Processor Fees

- $100 per application

- $258 per facility producing consumable hemp products

Other Info

- Retailers selling consumable hemp products much register each location where the products will be sold; cost is $155 per location.

- Handler fees: $100 application fee plus $100 per facility

Utah

Cultivator Fees

- $18 application fee

- $500 licensing fee

Processor Fees

- $18 application fee

- $2,000 licensing fee

Other Info

- Hemp retail permits: $50 per calendar year

Vermont

Cultivator Fees

- Hemp for personal use: $25

- Less than 0.5 acres/less than 500 lbs: $100

- 0.5 to 9.9 acres/less than 10,000 lbs: $500

- 10 to 50 acres/less than 50,000 lbs: $1,000

- More than 50 acres/50,000 lbs.: $3,000

- Indoor:

- 500 sq ft or less: $1,000

- More than 500 sq ft: $2,000

Processor Fees

- Tiered based on amount/type of processing:

- Grain/fiber – flat fee

- Floral, viable seed, or cannabinoid production – tiered fee based on whichever is greater, the number of acres planted or the weight of hemp or viable seed processed

- Indoor cultivation and processing of floral, viable seed, or cannabinoids – tiered fee based on size of cultivation area

- Calculator: http://cloud.agriculture.vermont.gov/HempCalculator/Calculator.aspx

Virginia

Cultivator Fees

- $150 application fee

Processor Fees

- $200 application fee

Other Info

- “Hemp dealer” license fee (for anyone who wants to temporarily possess industrial hemp grown in compliance with state or federal law that (i) has not been processed and (ii) was not grown and will not be processed by the person temporarily possessing it): $250

Washington

Cultivator Fees

- Annual license fee: $1,200

- License modification fee: $200

- Late licensing fee (after March 31): $200

- Inspection fees:

- $200 per inspection

- $40 per hour (including travel time – one way)

- Mileage will be charged at the rate established by the Washington State Office of Financial Management.

- When delta-9 THC concentration testing is performed at department-approved laboratories, testing fees will be subject to actual laboratory costs, including sample transportation.

Processor Fees

- Processor fees have not yet been established.

West Virginia

Cultivator Fees

- Application fee: $100 X the number of non-contiguous locations

- License fee: $100.00 + $5 per acre/$3 per 1,000 square foot of all properties applied

- Alteration fee: $50.00 + $100.00 + $5.00 per acreage of all properties non-contiguous

Processor Fees

- Annual registration fee of $200 per product.

- The annual fee for hemp product registrations shall be capped at $1,000 per manufacturer for products that are manufactured and sold in West Virginia.

- Hemp fiber products, such as rope, fiber, hempcrete, paper, and other industrial uses, are exempt from the $200.00 annual fee and certificate of analysis but are subject to all other registration requirements.

- Hemp products that are not consumed, inhaled, ingested, absorbed, come in contact with the skin, or otherwise have an effect on the health of humans or animals are exempt from the $200.00 annual fee and certificate of analysis but are subject to all other registration requirements.

Wisconsin

Cultivator Fees

- Annual grower registration fee: $350

- One-time grower license fees:

- $150 (0-30 acres)

- $5/acre (31-199 acres)

- $1,000 (200 acres or more)

- $250 per sample and test. Each lot needs at least one sample and test.

- $50 per license modification change (plus one-time fees for additional acreage)

Processor Fees

- Annual processor registration fee (waived for first year): $100

- One-time processor license fee: $150

Wyoming

Cultivator Fees

- $500 for each annual license or renewal application

Processor Fees

- $500 for each annual license or renewal application

Other Info

- $200 per sample conducted

- $200 per analysis conducted

- $250 for verification of effective disposal of cannabis or cannabis products that are in violation